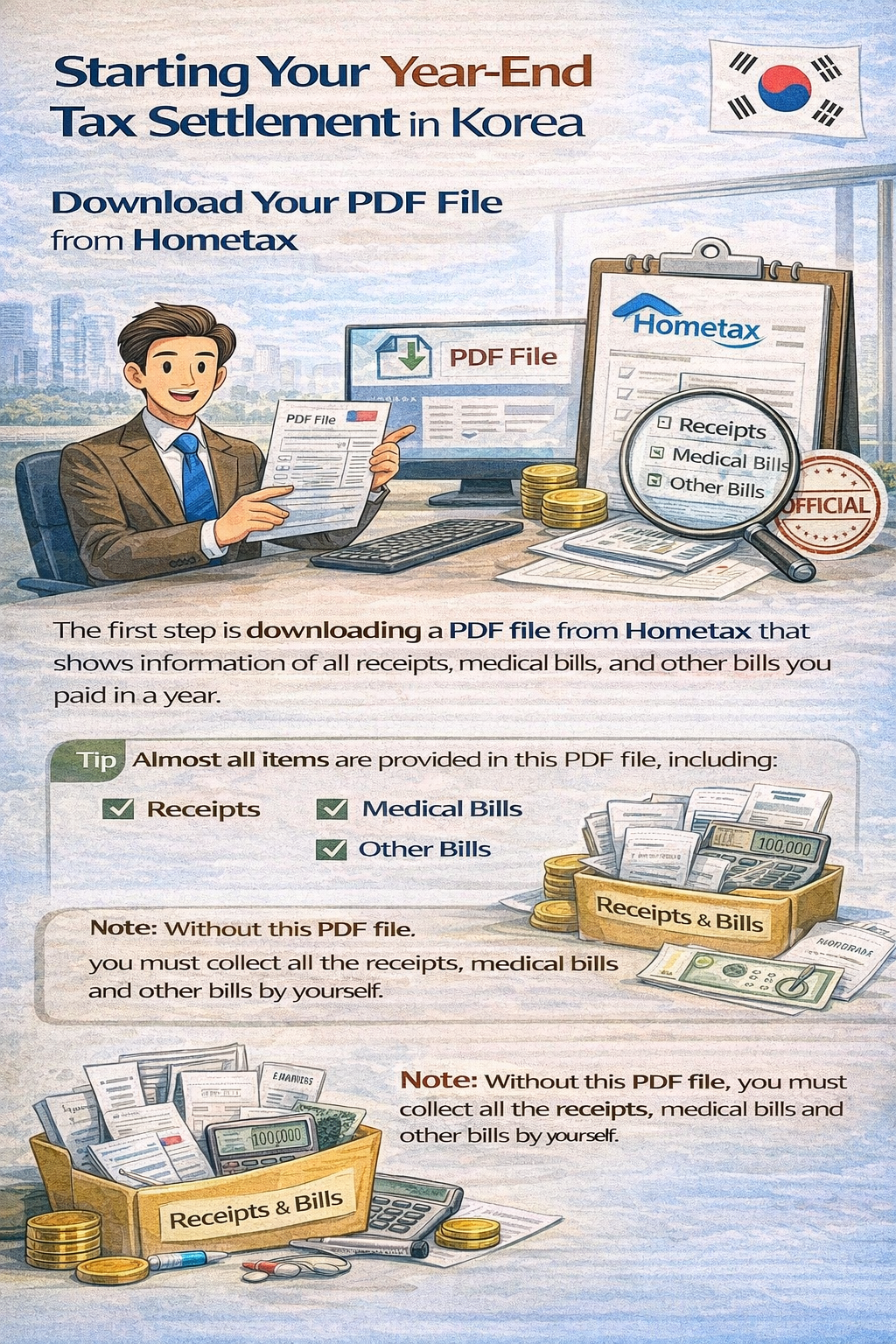

To start your year-end tax settlement in Korea, the very first thing you should do is to download ‘the PDF file’ from home tax. The PDF file shows information of all receipts,medical bills and other bills you paid in a year.

*If you don’t get this PDF file, you should collect all the receipts, medical bills and other bills by yourself

Almost all items are provided through this PDF file, but there might be items that this PDF file don't shows(e.g. donation / some medical expense).

1.Search 'Hometax' and enter the webistes

2.Click the '연말정산 간소화' in the left side

It's the temporary interface you can see when you enter Hometax websites during the 'year-end tax settlement' period. If you click the '연말정산 간소화' you can directly go to the tab

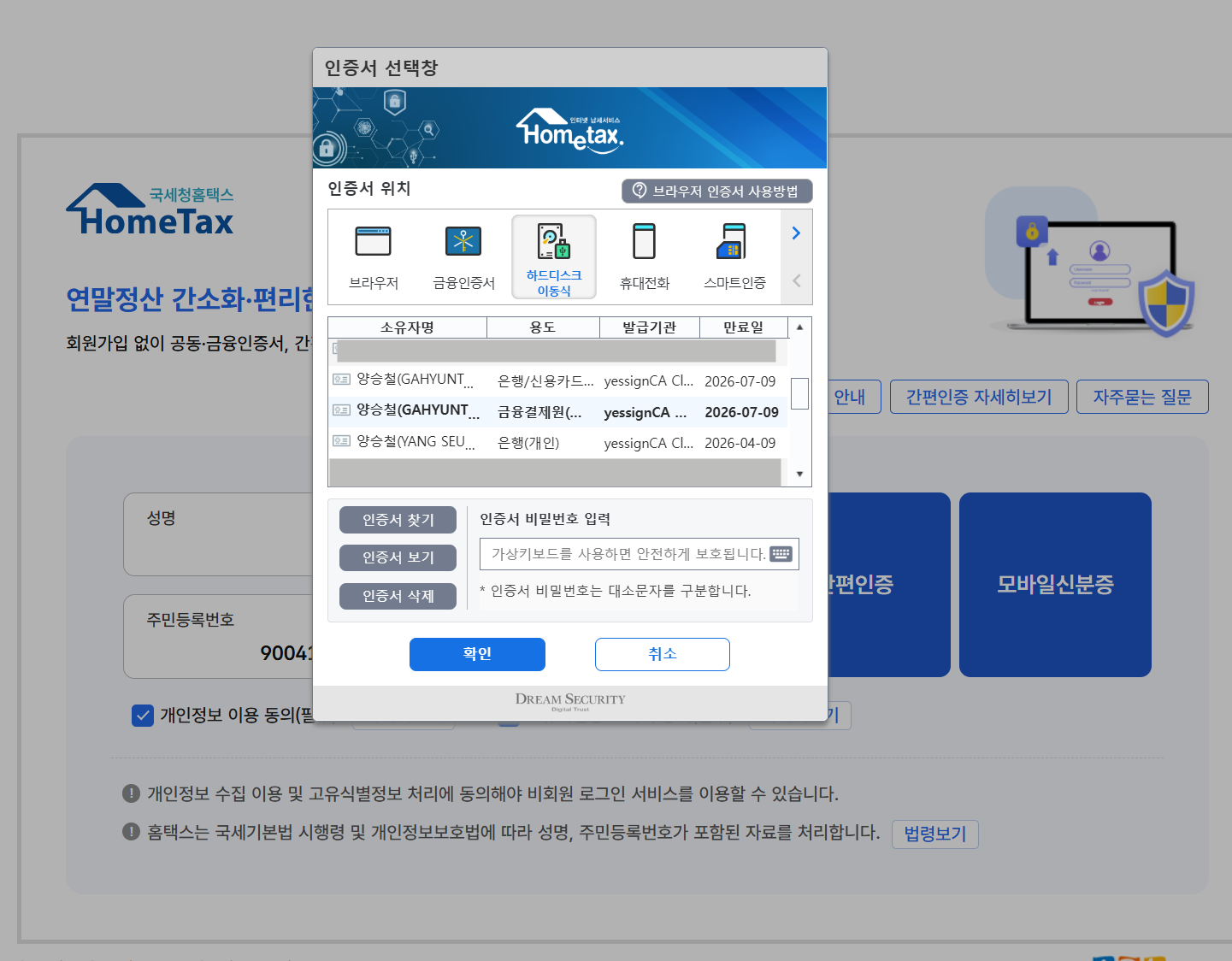

3.Login with your information

First, enter your name and registration number on the left-hand side, then click one of the following options: 공동,금융인증 / 간편인증 / 모바일신분증

3-1.If you have a personal digital certificate (not a company certificate, but your individual one), click “Joint/Financial Certificate (공동·금융인증)” and log in using your digital certificate.

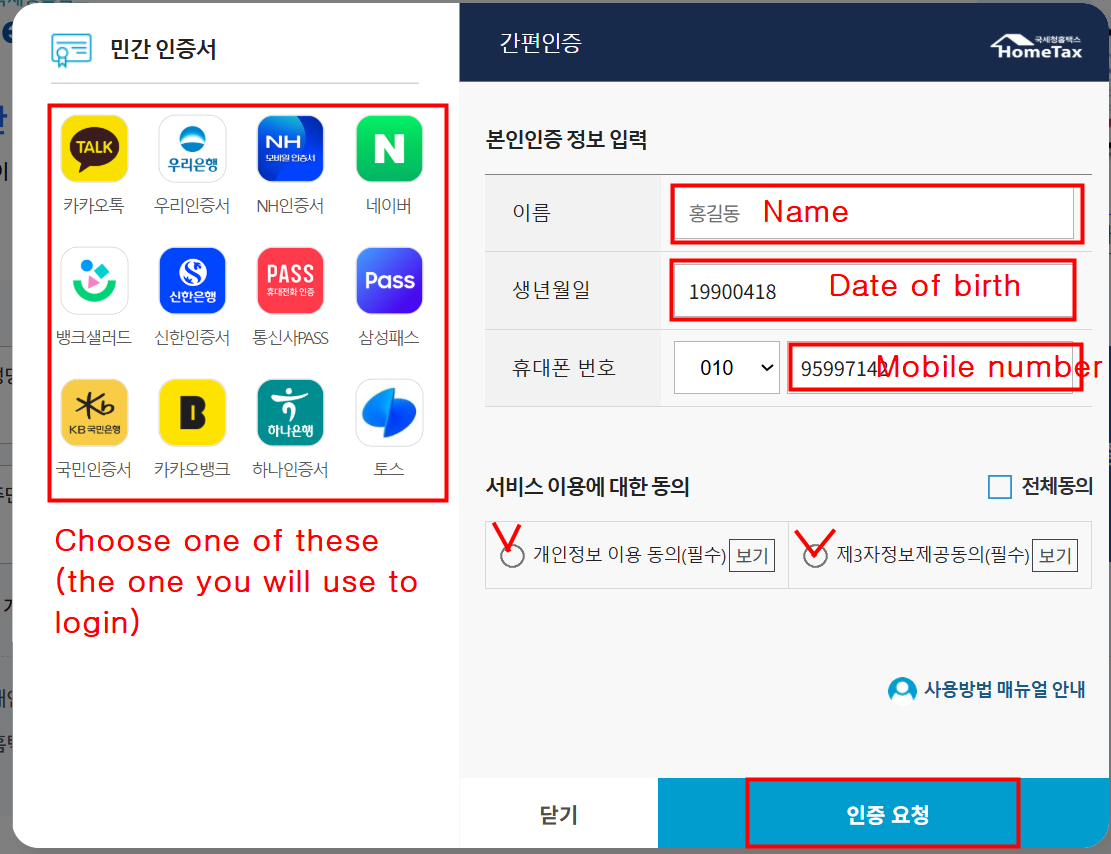

3-2.If you do not have a personal digital certificate, click “Simple Authentication (간편인증)” and choose one of the available applications to log in. Then, enter your name, date of birth, and mobile number, and click “Request Authentication (인증요청)”.

Then, you will receive an authentication notification from the app you selected (for example, I chose KakaoTalk). Proceed with the authentication and press “Complete Authentication (인증완료)

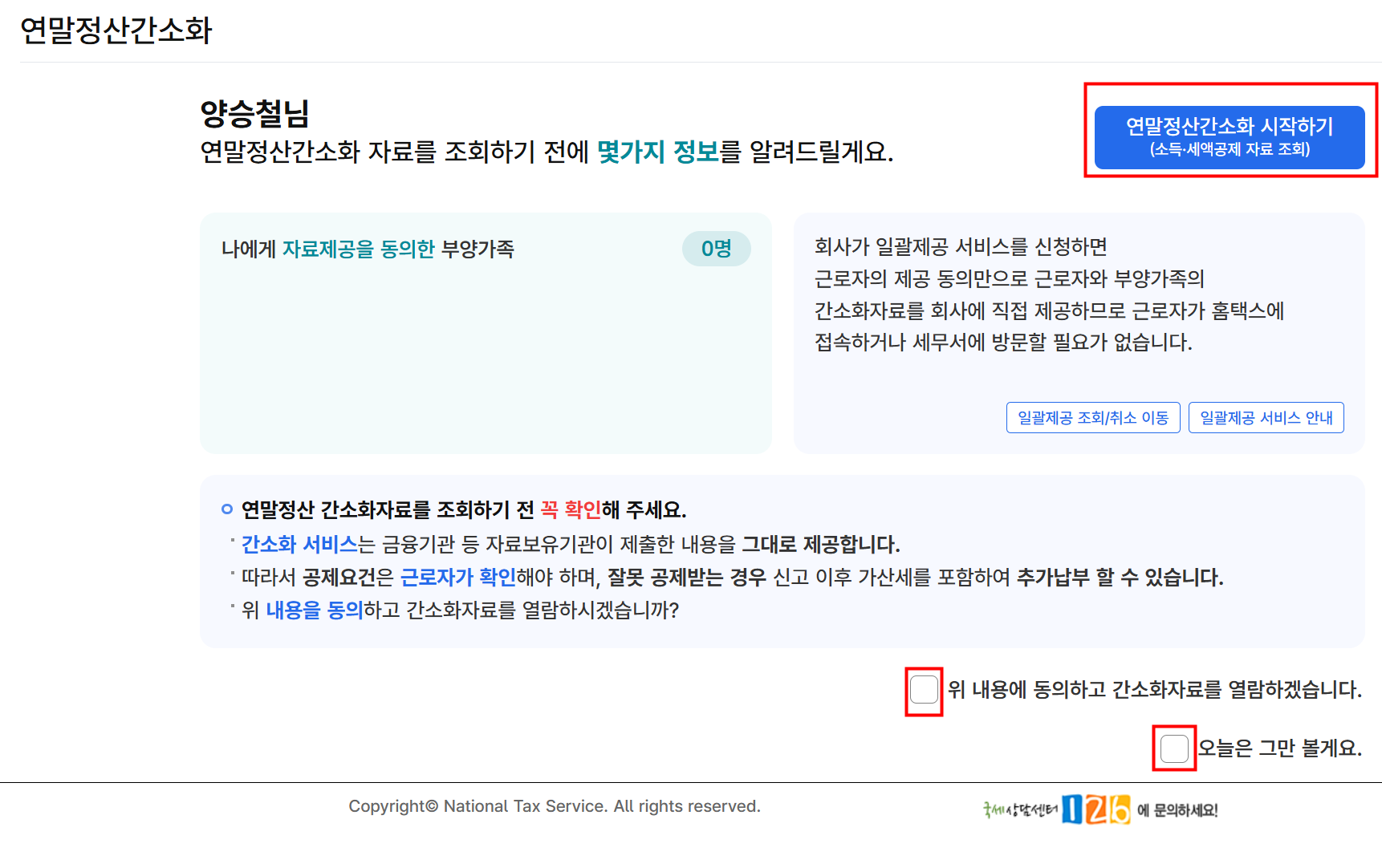

4. After checking the boxes below, press “Start Year-End Tax Settlement Simplification (연말정산 간소화 시작하기)”.

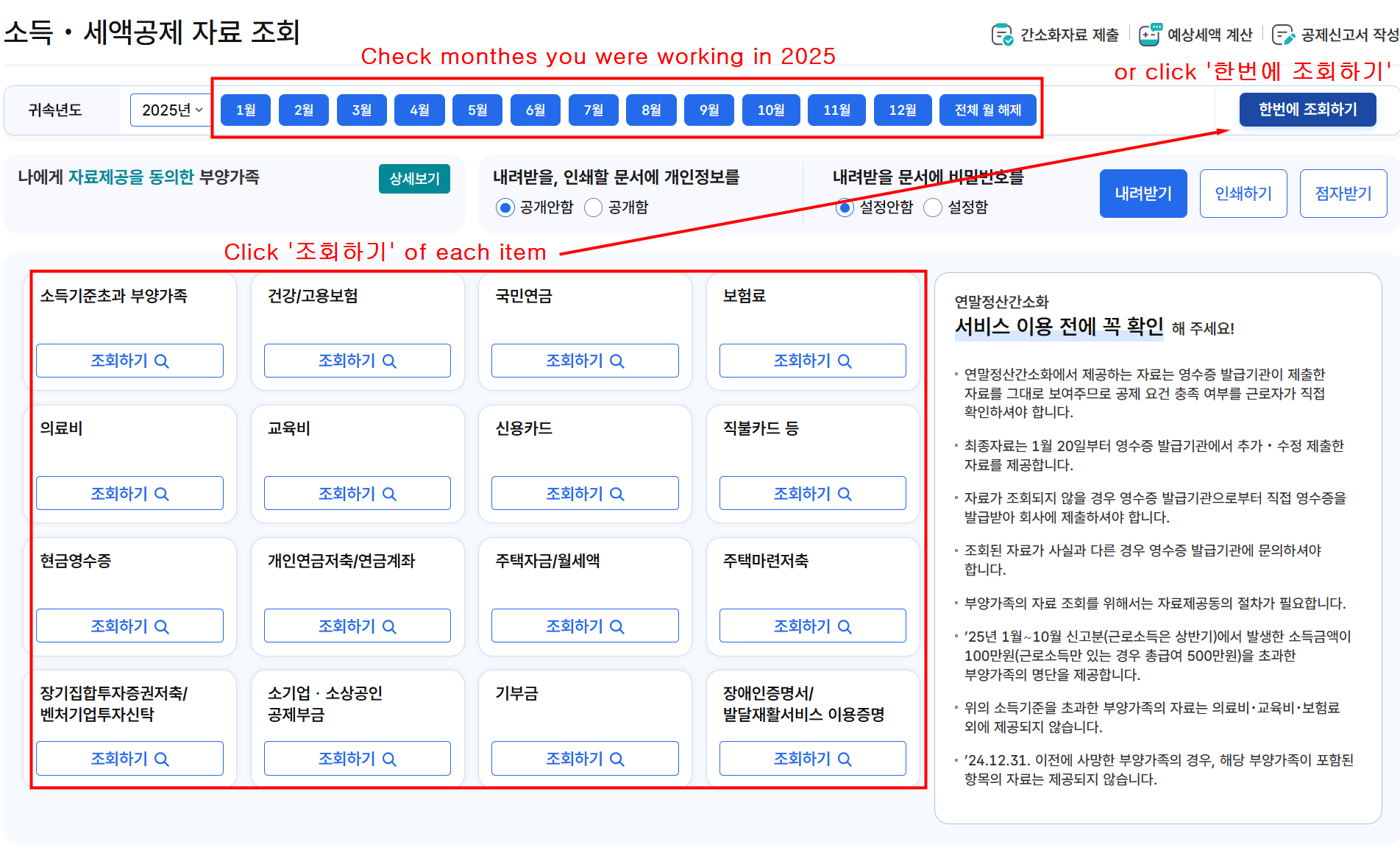

5. Select the month(s) you worked in 2025, and click “Search (조회하기)” for each deduction item. Alternatively, you can click “Search All at Once (한번에 조회하기)” to view all items together.

6. After reviewing the amounts for each deduction item, click “Download (내려받기)”.

6. you can download the PDF files by click 'PDF 내려받기'

You will need to provide the PDF file for the year-end tax settlement. While it is possible to complete the settlement without the PDF, the file contains detailed information on deductions for your taxes. By using the PDF, you may increase your chances of receiving a larger tax refund.

G-tax(Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 32 832 6698

steven@g-tax.kr

'Korea tax guide[Hometax]' 카테고리의 다른 글

| Your 2026 January Tax schedule (0) | 2026.01.02 |

|---|---|

| December 2025 Tax schedule (0) | 2025.12.01 |

| November 2025 Tax schedule (0) | 2025.10.30 |

| Ocotober 2025 Tax schedule (0) | 2025.10.10 |

| Sep 2025 Tax schedule in Korea (0) | 2025.08.27 |