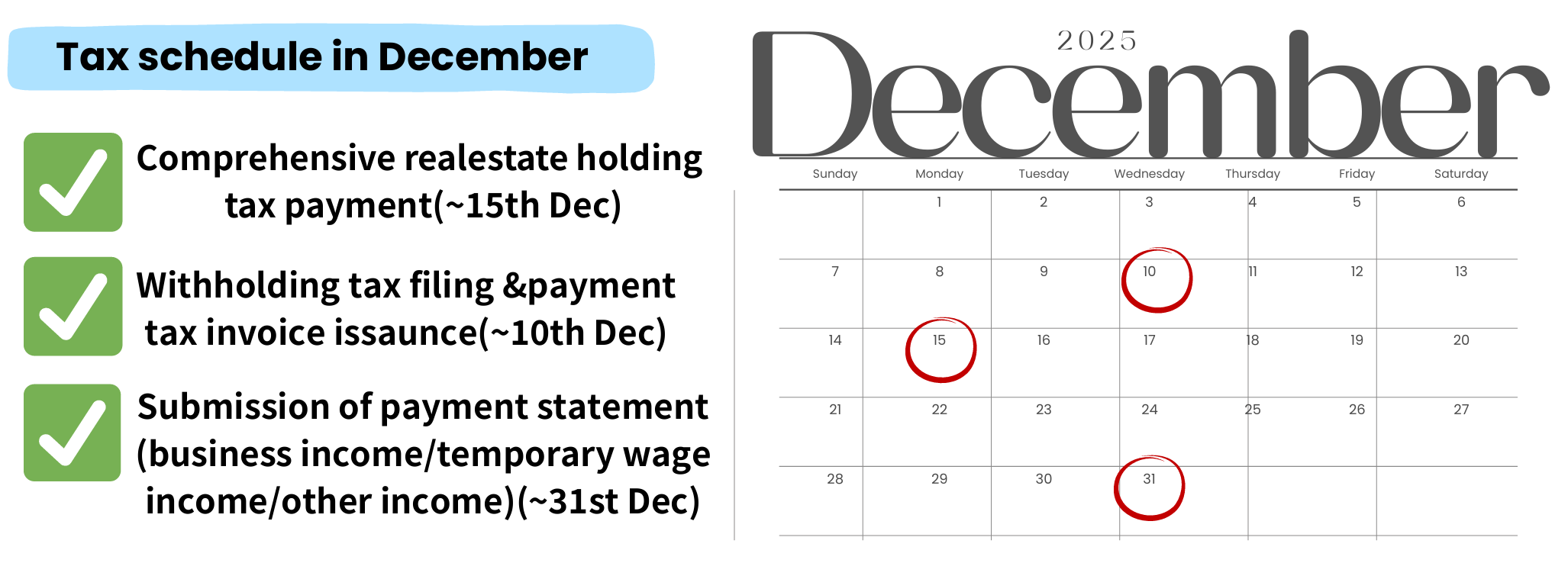

If you own real estate in South Korea, you may be required to pay this tax. However, not all real estate is subject to the Comprehensive Real Estate Holding Tax. As the name suggests, this tax combines the value of all the realestate in Korea you own, and if the total exceeds a certain threshold, you must pay the tax.

Although the rules are quite complex, to put it simply:

If you own a house in Korea and its taxable value exceeds KRW 900,000,000 (approx. USD 612,000) — or KRW 1,200,000,000 (approx. USD 816,000) if you own only one house — you are subject to this tax.

The Korean government already knows what real estate you own (because all properties must be registered at the time of purchase) and the taxable value (because it is based on the government-published official property value).

Therefore, the tax office sends you a tax payment notice, and you can simply pay the amount indicated. If you disagree with the assessment, you may file an appeal with tax office or tax court.

When you pay your employees a salary, it is your responsibility to deduct taxes from their salary before paying them.

*For example, if your employee has a contracted salary of 2,000,000 KRW, you must deduct 100,000 KRW for taxes, and pay your employee 1,900,000 KRW. The 100,000 KRW you deducted must be reported on a withhold tax return and paid to the tax office on behalf of your employees.

The deadline for filing the withholding tax return is the 10th day of the following month after the payment was made. So, if you paid salaries to your employees in Nov, you must file the withholding tax return by December 10th. (it's usually 10th of following month of the month you paid, but because of the long holiday in this month, it's extended to 15th)

It's important to understand that the requirement to file a withholding tax return is not limited to salary payments. Any payment that requires taxes to be withheld must be reported on the withholding tax return.

*For instance, if you paid a loyalty payment to a foreign entity, you must also withhold taxes and report the payment on the withholding tax return.

The payment statement is a necessary document that outlines information about the individuals or entities who have received payments from you or your company. This includes details about their income and any taxes that have been withheld.

*For instance, when you pay your employees, you are required to withhold taxes and pay them to the tax office. Additionally, you must submit a payment statement to the tax office to report the withheld taxes.

-Business income/Temporaty worker income/other income -> Monthly submission

-Salary income -> Semiannaully sbmission (July, Jan)

Companies must prepare and submit these statements to the tax office by the end of July.

If a company fails to submit the statements within the due dates, penalty taxes will be incurred.

G-tax(Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 32 832 6698

steven@g-tax.kr

'Korea tax guide[Hometax]' 카테고리의 다른 글

| Your Year-end tax settlement guide 2026 [PDF download] (0) | 2026.01.23 |

|---|---|

| Your 2026 January Tax schedule (0) | 2026.01.02 |

| November 2025 Tax schedule (0) | 2025.10.30 |

| Ocotober 2025 Tax schedule (0) | 2025.10.10 |

| Sep 2025 Tax schedule in Korea (0) | 2025.08.27 |