If your company is a Small or Medium-sized Enterprise (SME) in Korea, you may be eligible for special tax reductions under the "Act on Restriction on Special Cases Concerning Taxation."

Here's how you can check your company's SME status and understand the special tax reductions

1.Criteria for Small or medium enterprises

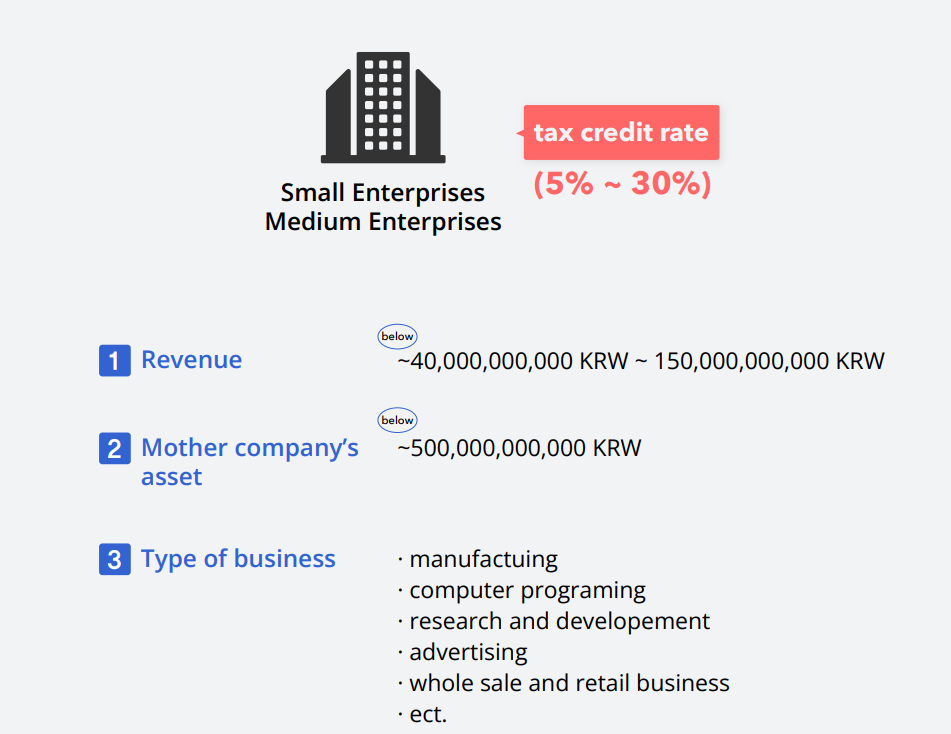

Determining whether a company qualifies as a Small or Medium Enterprise (SME) in Korea depends on factors such as revenue and the total assets of the mother company.

Here are the criteria for SME classification:

1) Revenue:

The required revenue thresholds for SME classification vary depending on the industry. It typically ranges from 40,000,000,000KRW to 150,000,000,000KRW. therefore, if your company's annual sales are below 40,000,000,000KRW, you can consider it a small enterprise.

If your company's revenue falls below 1,000,000,000KRW to 12,000,000,000KRW, it may qualify as a small enterprise eligible for a higher tax reduction rate.

2) Mother Company's Assets:

For foreign companies with a mother company abroad, the total assets of the mother company are significant. Even if a company in Korea might be considered small, if another company owns 30% or more of its shares and the total assets of that owning company exceed 500,000,000,000KRW, the subsidiary company may not qualify as a small or medium enterprise.

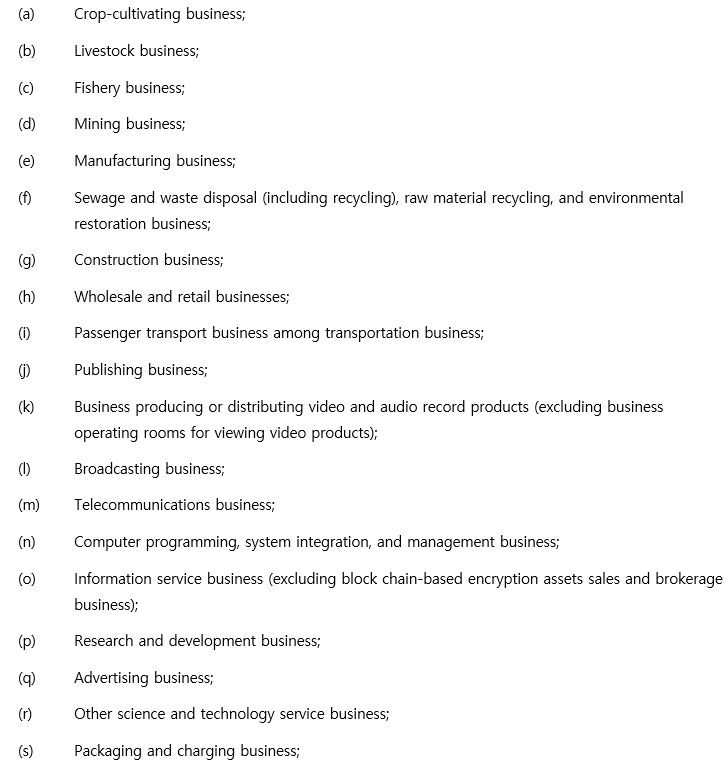

2.Types of business that can get the tax reductions

To qualify for special tax reductions, your company must engage in specific types of business activities as defined by the law. The list provided contains some examples of these eligible business types. It's important to note that there are additional types of business that may also be eligible for tax benefits.

3.Tax reductions rates are different depends on the type of business and size

Below are the tax reduction rates, and as you can observe, businesses located outside of the Seoul metropolitan area are eligible for higher tax reductions. These tax reduction rates can significantly impact your overall tax liability, making it advantageous for businesses in non- metropolitan areas to consider these incentives when planning their operations and investments.

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact me through the information in the name card.