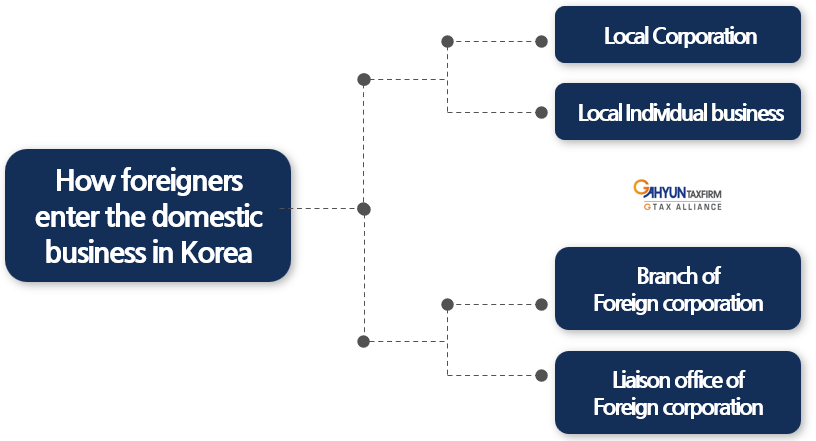

When foreigners enter the Korean domestic business landscape, they have four options: establishing a local Korean corporation, creating a local Korean individual business, forming a branch of a foreign corporation, or establishing a liaison office for a foreign corporation.

"The first two options (local corporation and individual business) fall under the purview of the Foreign Investment Promotion Act, while the last two options (liaison office and branch) are governed by the Foreign Exchange Transaction Act."

1.Local Corporation(foreign investment corporation)

Establishment of a local entity by foreigners for investment in South Korea is subject to the regulations of the Foreign Investment Promotion Act and the Commercial Act, and such an entity is considered a domestic corporation. Here, foreigners refer to individuals holding foreign nationality, corporations established under foreign laws, and institutions representing foreign governments engaged in external economic cooperation activities.

To establish a corporation that can be registered as a foreign- invested enterprise, the investment amount must be at least 100 million KRW (Korean Won), as per Article 2 of the Enforcement Decree of the Foreign Investment Promotion Act.

2.Local Individual business (foreign investment indivicual business)

If a foreigner invests over 100 million KRW in a business as a individual business in South Korea, it is also considered foreign investment. In such cases, just like with local corporations, they would be subject to the Foreign Investment Promotion Act. Operating a business as a sole proprietorship offers the advantage of simplicity when it comes to starting, suspending, or closing the business compared to establishing a local corporation. However, it may have the disadvantage of lower international creditworthiness, making it challenging to secure funding and recruit top talent.

3.Branch of Foreign corporation

For a foreign company to conduct regular business activities in South Korea, they must appoint a representative for their local branch and follow the establishment procedures as per the Foreign Exchange Transaction Act. Additionally, registration with the court is required.

A branch is considered a permanent establishment under treaties because it engages in revenue-generating business activities in the country. Therefore, the same corporate tax rates that apply to local corporations are also applicable to income generated from business activities conducted in South Korea.

4.Liaison office of foreign corporation

A liaison office,unlike a branch office, cannot engage in operational activities and is limited to non-operational activities for the benefit of the head office. As a result, it only receives a unique identification number similar to business registration from the local tax office and does not require registration with the court.

The functions that a liaison office can perform are of a preparatory and auxiliary nature, including business liaison with the head office, market research, quality control, advertising, public relations, information collection and provision, and similar activities. Direct sales or maintaining product inventories for sales are not allowed, which means that no domestic source income is generated by a liaison office.

For various reasons, many foreigners who wish to start a business in Korea opt for one of two options: (1) a Foreign Investment Corporation or (3) a Branch of a Foreign Corporation. Below is a comparison table illustrating the differences between these two choices.

One advantage of establishing a branch is that there is no minimum investment requirement for setup. However, it's important to note that a branch is not a separate entity; it operates as a subordinate extension of the foreign company."

| Classifiaction | Foreign investment corporation (Local corporation) |

Branch of Foreign corporation (Foreign corporation) |

| Law | Foreign investment promotion | Foreign Exchange Transaction Act |

| Independency | "Foreign investor" and "foreign-invested enterprise" are considered separate legal entities. (They perform independent accounting and financial reporting.) |

The main office(foreign corporation in abroad) and branch are the same legal entity. (They share the same accounting and financial reporting.)" |

| Minimum investment amount |

100,000,000KRW | None |

| Tax liaibility | Tax liability exists for all domestic and foreign income. | Tax liability exists only for domestic source income. Branch tax obligation (France, Morocco, Brazil, Indonesia, Canada, Kazakhstan, the Philippines, Panama, Thailand, Peru, India)." |

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

you can contact me through the information in the name card.