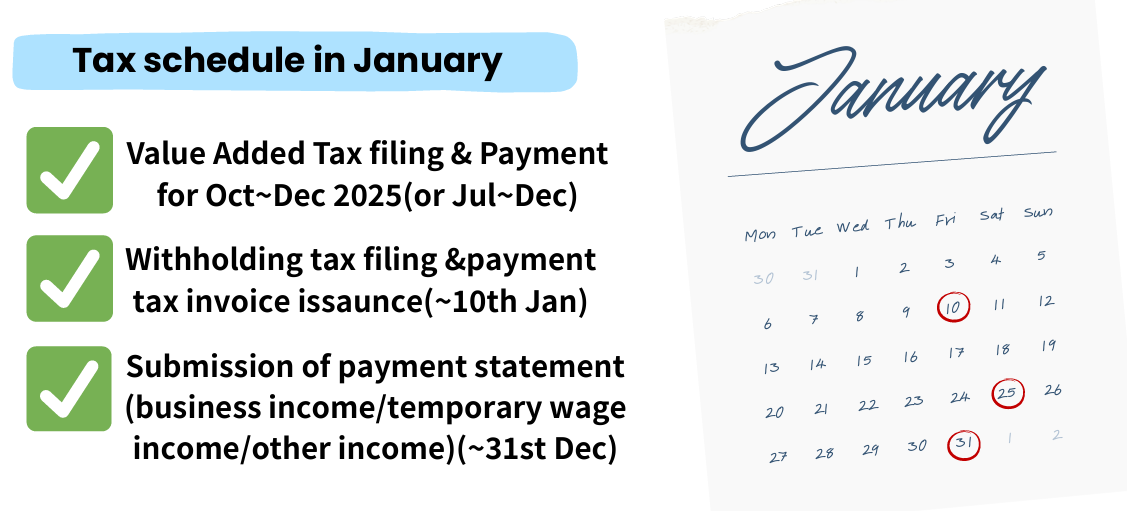

Your 2026 January Tax schedule

Nobody can deny that the most important tax schedule in January is VAT filing. The VAT return includes the company's revenues and costs and is reported to the tax office. This means that the company's revenues and costs are finalized. Once reported, it is difficult to correct these figures, so VAT filing is crucial.

Unlike last October's VAT filing, which only corporation file their 3Q VAT and individual business don't, In January, every business entity regardless of business type (corporation / individual business).

But for corporation, which already filied their 3Q(Jul~Sep) VAT, only have to file for 2Q(Oct~Dec).

A tax invoice should be issued when a company supplies goods or completes services.However, under Korean tax law, it is allowed to issue the tax invoice by the 10th of the following month.

Therefore, if you supplied goods or services in December and did not issue a tax invoice at that time, you can still issue it by January 10. If the tax invoice is issued after January 10 for December transactions, penalty taxes may apply due to late issuance.

Similarly, if you have made purchases and have not yet received the tax invoice from your supplier, you should request it by January 10.

If you missed some tax invoices that should have been included in the 3rd-quarter VAT filing last October, you can include them in this month’s VAT return and claim a deduction for them

For individual business owners (or small corporate businesses) who did not file a VAT return for the 3rd quarter but paid some VAT during that period, the paid amount can be deducted in this month’s VAT return.

For corporate businesses that filed the 3rd-quarter VAT return and had no VAT payable but only a refundable amount, the refund can be claimed in this month’s VAT return.

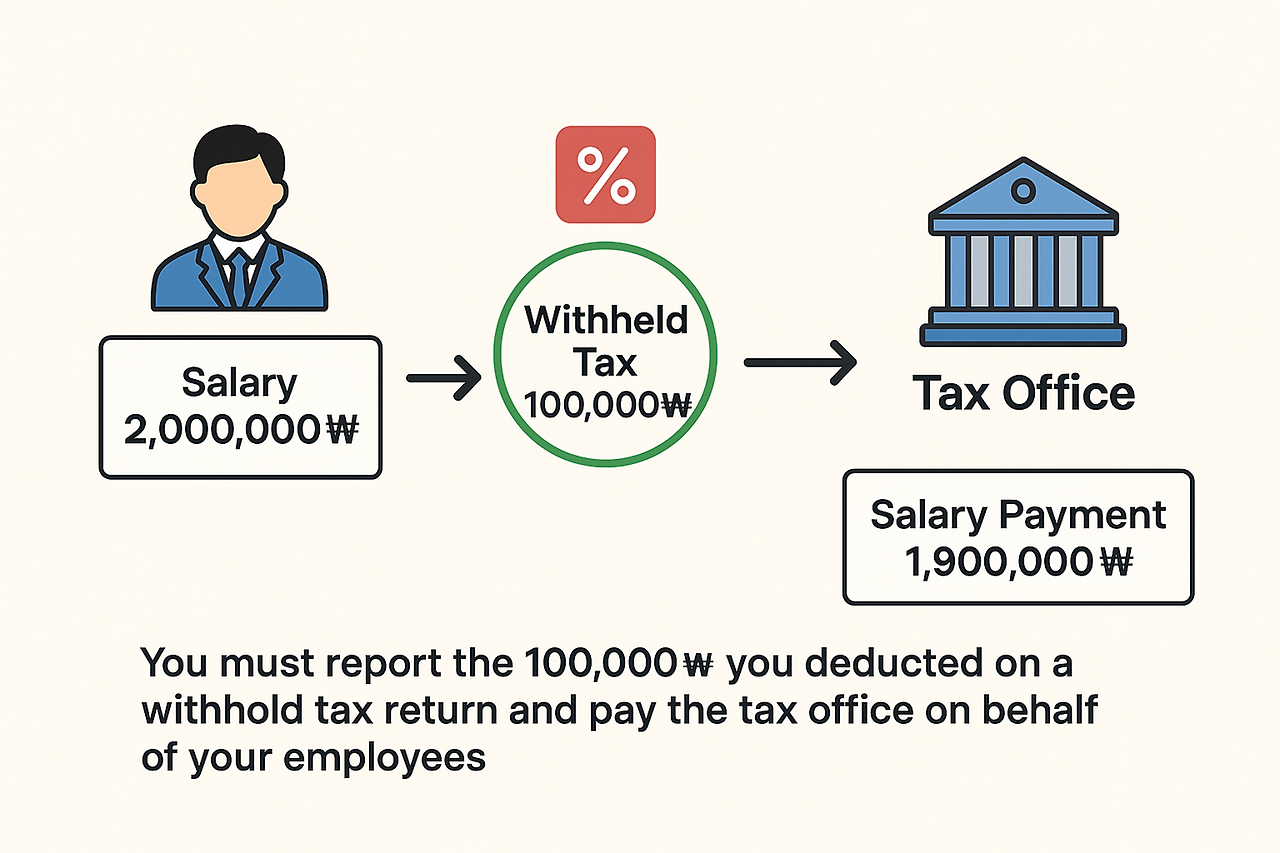

When you pay your employees a salary, it is your responsibility to deduct taxes from their salary before paying them.

*For example, if your employee has a contracted salary of 2,000,000 KRW, you must deduct 100,000 KRW for taxes, and pay your employee 1,900,000 KRW. The 100,000 KRW you deducted must be reported on a withhold tax return and paid to the tax office on behalf of your employees.

The deadline for filing the withholding tax return is the 10th day of the following month after the payment was made. So, if you paid salaries to your employees in Dec, you must file the withholding tax return by January 10th. (it's usually 10th of following month of the month you paid, but because of the long holiday in this month, it's extended to 15th)

It's important to understand that the requirement to file a withholding tax return is not limited to salary payments. Any payment that requires taxes to be withheld must be reported on the withholding tax return.

*For instance, if you paid a loyalty payment to a foreign entity, you must also withhold taxes and report the payment on the withholding tax return.

The payment statement is a necessary document that outlines information about the individuals or entities who have received payments from you or your company. This includes details about their income and any taxes that have been withheld.

*For instance, when you pay your employees, you are required to withhold taxes and pay them to the tax office. Additionally, you must submit a payment statement to the tax office to report the withheld taxes.

-Business income/Temporaty worker income/other income -> Monthly submission

-Salary income -> Semiannaully sbmission (July, Jan)

Companies must prepare and submit these statements to the tax office by the end of July.

If a company fails to submit the statements within the due dates, penalty taxes will be incurred.

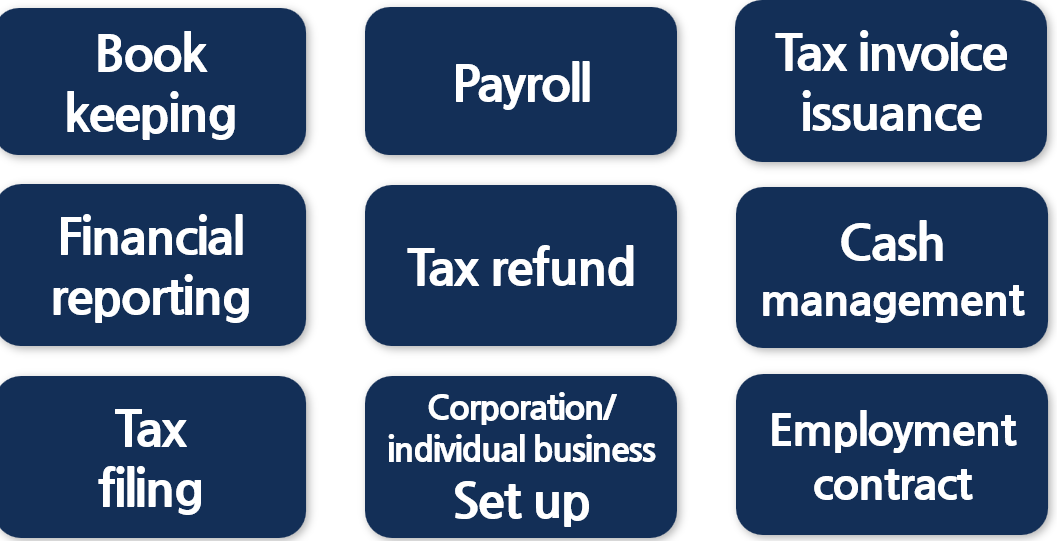

G-tax(Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 32 832 6698

steven@g-tax.kr