[2026 Changes] Why Your Take-Home Pay May Decrease

In 2026, several changes will affect your monthly salary in Korea.

For the first time in 20 years, the national pension contribution rate will increase. Health insurance premiums will also go up.

The good news is that employment insurance and industrial accident compensation insurance rates will remain unchanged.

1. Increase in Health Insurance Rates

In 2025, the health insurance contribution rate was 7.09%.

If you are an employee, this contribution is shared equally between you and your employer, meaning 3.545% of your salary was deducted each month.

Starting January 1, 2026, the rate will increase to 7.19%, an increase of 0.1 percentage points. As a result, the employee’s share will rise to 3.595% of salary.

In addition, the long-term care insurance premium, which is calculated as a percentage of the health insurance contribution, will also increase—from 12.95% to 13.14% of the health insurance amount.

2. Increase in National Pension Rates

The national pension contribution rate remained at 9% for nearly 20 years without change.

However, starting in 2026, the rate will increase to 9.5%, with further gradual increases expected in the coming years.

As with health insurance, the national pension contribution is shared equally between the employer and the employee. This means the employee’s contribution will rise from 4.5% to 4.75% of salary.

Although the national pension rate is higher than the health insurance rate, it is subject to a monthly contribution cap.

Contributions are calculated only up to a monthly salary of KRW 6,370,000, meaning the maximum employee contribution is capped at KRW 302,575 per month (6,370,000 × 4.75%).

3. How Much Will Your Take-Home Pay Decrease?

As national pension and health insurance contribution rates increase, your take-home pay will decrease if your gross salary remains unchanged.

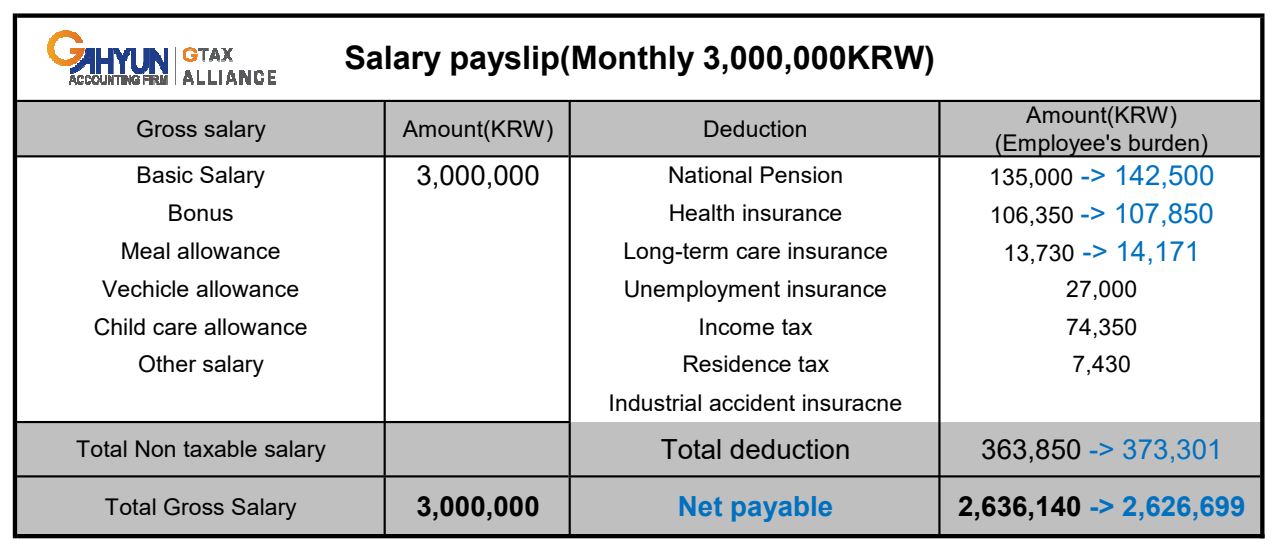

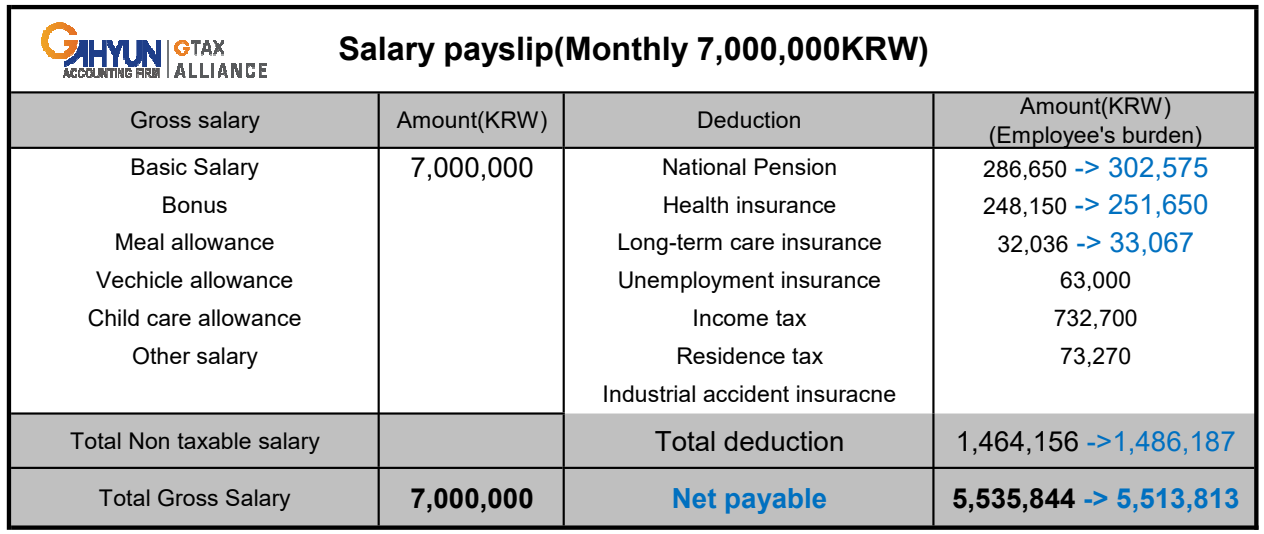

Below is a simulation showing how much net pay decreases at different gross salary levels. This allows you to see the actual impact on your monthly take-home pay, depending on your salary amount.

1)Gross salary 3,000,000KRW per month

2)Gross salary 5,000,000KRW per month

3)Gross salary 7,000,000KRW per month

You may think the decrease in Net-pay is not significant. That’s true, but it’s still a bit annoying, isn’t it?

4. Increase in Minimum Wage

The minimum hourly wage for 2026 has been set at KRW 10,320, representing a 2.9% increase from KRW 10,030 in 2025.

When converted to a monthly salary, this amounts to KRW 2,156,880 in 2026, up from KRW 2,096,270 in 2025, based on a 40-hour workweek and including paid weekly holidays.