Ocotober 2025 Tax schedule

This October 2025 comes with an unprecedentedly long holiday. From the 3rd to the 12th, including weekends, there will be a total of nine consecutive days off. If you’re from a European country, you might think it’s not a big deal — but for Koreans, it certainly is.

For us as tax accountants, it’s particularly significant because the long holiday makes the tax filing deadlines quite tight. We appealed to the Korean government, and they allowed an extension for certain tax filing and payment due dates.

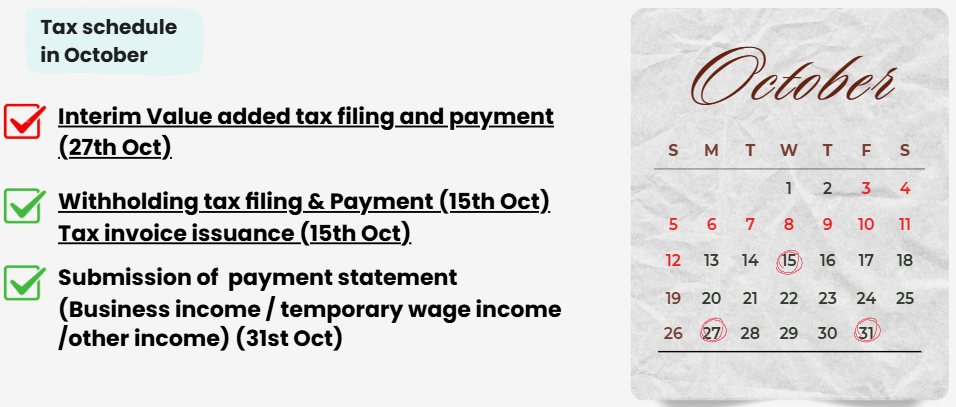

Please check the tax filing deadlines for October below.

If you run a small business as an individual, you will receive a VAT payment notice from the tax authority. Even if you don’t file a VAT return this time, you are required to pay 50% of the VAT amount you paid in your last VAT filing.

This is an advance tax payment that will be deducted from the amount due in your next VAT filing, which is scheduled for January.

Corporations must file their VAT returns every quarter. This is important because it shows the company's sales and VAT-related costs. Corporations should also submit a breakdown of tax invoices.

So Ensure that all invoices have been issued or received before VAT filing.

When you pay your employees a salary, it is your responsibility to deduct taxes from their salary before paying them.

*For example, if your employee has a contracted salary of 2,000,000 KRW, you must deduct 100,000 KRW for taxes, and pay your employee 1,900,000 KRW. The 100,000 KRW you deducted must be reported on a withhold tax return and paid to the tax office on behalf of your employees.

The deadline for filing the withholding tax return is the 10th day of the following month after the payment was made. So, if you paid salaries to your employees in Sep, you must file the withholding tax return by October 15th. (it's usually 10th of following month of the month you paid, but because of the long holiday in this month, it's extended to 15th)

It's important to understand that the requirement to file a withholding tax return is not limited to salary payments. Any payment that requires taxes to be withheld must be reported on the withholding tax return.

*For instance, if you paid a loyalty payment to a foreign entity, you must also withhold taxes and report the payment on the withholding tax return.

The payment statement is a necessary document that outlines information about the individuals or entities who have received payments from you or your company. This includes details about their income and any taxes that have been withheld.

*For instance, when you pay your employees, you are required to withhold taxes and pay them to the tax office. Additionally, you must submit a payment statement to the tax office to report the withheld taxes.

-Business income/Temporaty worker income/other income -> Monthly submission

-Salary income -> Semiannaully sbmission (July, Jan)

Companies must prepare and submit these statements to the tax office by the end of July.

If a company fails to submit the statements within the due dates, penalty taxes will be incurred.

G-tax(Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 32 832 6698

steven@g-tax.kr