What's new on 2026 tax law in Korea?

The Korean government has announced tax law updates for next year. As this announcement serves as a guideline, it does not constitute confirmed tax law. Some provisions will be confirmed next year through updated legal clauses, while others may be deleted or changed.

The government announcement includes many items, but here we introduce three important updates that you should be aware of.

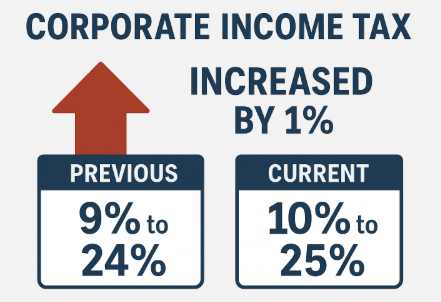

①CIT rates increase

Corporate income tax, which is the tax that corporate businesses pay every March, has recently increased by 1%. Previously, the rates were 9% to 24%, but they have now risen to 10% to 25%. About two years ago, the former government had reduced the rates, and the current government has restored them to the higher range of 10% to 25%.

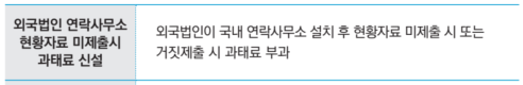

②Penalty tax for not reporting liaison office status report

Liaison offices are required to report their current status to the tax office every February, including information such as office address, number of employees, and details of operational fund usage. Previously, there was no penalty obligation to submit this report. However, starting in 2026, penalty clauses are planned to be introduced for non-compliance. The exact penalty amounts have not yet been announced but the maximum penalty amounts are 10,000,000KRW.

③Increase of security transaction tax and ease standard for major shareholder

Securities transaction taxes are levied on share transactions. Previously, the rates were 0% for the KOSPI market and 0.15% for the KOSDAQ market. The new rates will be 0.05% for KOSPI and 0.20% for KOSDAQ.

In addition, the standard for defining a major shareholder is being relaxed. This means more shareholders will be liable to pay capital gains tax on share transfers. In Korea, under open market transactions, only major shareholders are required to pay capital gains tax, so this change is significant.

The threshold for major shareholders has been lowered from 5,000,000,000 KRW (approximately 3,598,416 USD / 3,086,381 EUR) per company to 1,000,000,000 KRW (approximately 719,683 USD / 617,303 EUR) per company.

④Obligation to submit limited tax rates application to tax office

G-tax(Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr