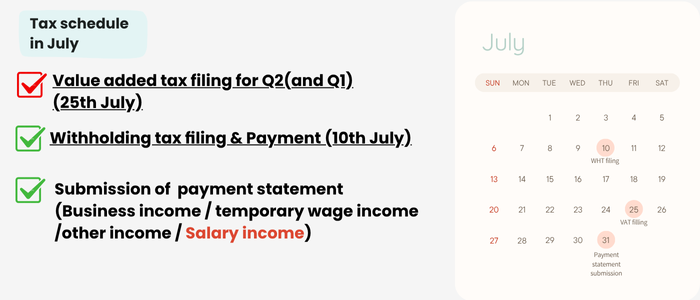

July 2025 Tax schedule in Korea

Nobody can deny that the most important tax schedule in July is VAT filing. The VAT return includes the company's revenues and costs and is reported to the tax office. This means that the company's revenues and costs are finalized. Once reported, it is difficult to correct these figures, so VAT filing is crucial.

Unlike April's VAT filing, which only corporation file their 1Q VAT and individual business don't, In July, every business entity regardless of business type (corporation / individual business).

But for corporation, which already filied their 1Q(Jan~Mar) VAT, only have to file for 2Q(Apr~Jun).

A tax invoice should be issued when a company provides goods or completes services. However, according to Korean tax law, it is allowed to issue the tax invoice by the following month.

For example, if you provided goods or services on June 15th, you can issue the invoice by July 10th without any penalty. If you issue the tax invoice after the 10th of the following month, there might be penalty taxes for delayed issuance.

if you missd some tax invoices which should be included in 1Q VAT filing, you can put that in this month's VAT filing.

For individual business owner, which hadn't filie for 1Q VAT but paid some amounts of VAT amount in Q1, they can deduct the amounts in this month's VAT filing. and for Corporation business, which had filed for 1Q, but no VAT payable amounts but only refundable amounts can get the refund amount in this month's VAT filing.

2.Withholding tax filing(7/10)

When you pay your employees a salary, it is your responsibility to deduct taxes from their salary before paying them.

*For example, if your employee has a contracted salary of 2,000,000 KRW, you must deduct 100,000 KRW for taxes, and pay your employee 1,900,000 KRW. The 100,000 KRW you deducted must be reported on a withhold tax return and paid to the tax office on behalf of your employees.

The deadline for filing the withholding tax return is the 10th day of the following month after the payment was made. So, if you paid salaries to your employees in June, you must file the withholding tax return by July10th.

It's important to understand that the requirement to file a withholding tax return is not limited to salary payments. Any payment that requires taxes to be withheld must be reported on the withholding tax return.

*For instance, if you paid a loyalty payment to a foreign entity, you must also withhold taxes and report the payment on the withholding tax return.

3.Submission of payment statement (Business income, temporary worker income,other inocme, Salary income) (~7/31)

The payment statement is a necessary document that outlines information about the individuals or entities who have received payments from you. This includes details about their income and any taxes that have been withheld.

*For instance, when you pay your employees, you are required to withhold taxes and pay them to the tax office. Additionally, you must submit a payment statement to the tax office to report the withheld taxes.

-Business income/Temporaty worker income/other income -> Monthly submission

-Salary income -> Semiannaully sbmission (July, Jan)

Companies must prepare and submit these statements to the tax office by the end of July.

If a company fails to submit the statements within the due dates, penalty taxes will be incurred.