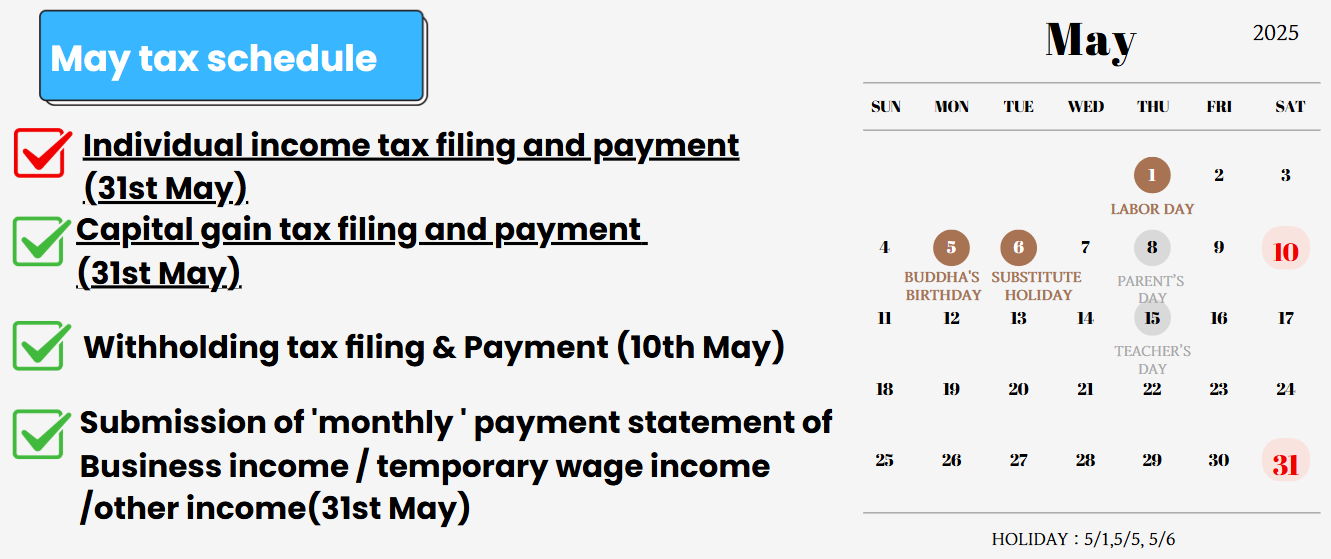

May 2025 Tax schedule in Korea

In Korea, May is often called the "month of family" because it includes several holidays like Children’s Day, Parents’ Day, Buddha’s Birthday, and Labor Day. People usually have more time to spend with their families compared to other months.

However, for individual business owners or those who have income other than wages or salary, May is also the month for filing and paying income tax.

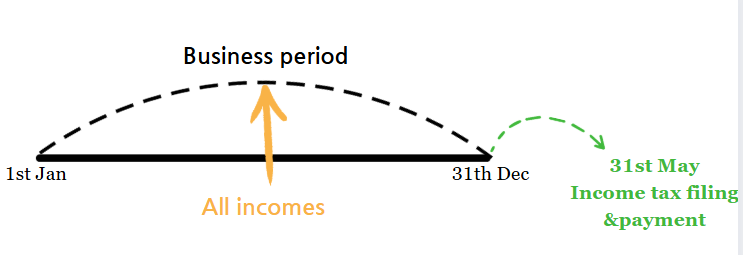

1.Individual income tax filing and payment (31st May)

If you own a business as an individual business, May is the month when you must file your income earned in the previous year. (For example, May 2025 is for reporting income from 2024.)

Even if you're not running a business, if you have any income besides your salary from your company, you may still be required to file an income tax return. If you're unsure, please check the post below for more details.

Who is Required to File an Income Tax Return in Korea?

As we approach the month of May, it is important to note that it is the season for individuals to file their personal taxes. According to Korean tax law, any resident (regardless of nationality) who earned an income during the previous year (between Januar

www.g-tax.kr

2.Capital gain tax filing for foreign share transfer

If you've invested in foreign stock markets and earned income from selling shares, you're required to file a tax return and pay taxes if your capital gains exceed 2,500,000 KRW. This threshold is the basic deduction amount—so if your gains are below 2,500,000 KRW, there's no tax to pay and no filing obligation.

One more thing to keep in mind: capital gains are filed separately from your regular individual income tax return. So, if you have both business income and capital gains, you must file both tax returns.

3.Withholding tax filing(10th May)

When you pay your employees a salary, it is your responsibility to deduct taxes from their salary before paying them.

*For example, if your employee has a contracted salary of 2,500,000 KRW, you must deduct 35,600 KRW for taxes, and pay your employee 2,464,400 KRW. The 35,600 KRW you deducted must be reported on a withhold tax return and paid to the tax office on behalf of your employees.

The deadline for filing the withholding tax return is the 10th day of the following month after the payment was made. So, if you paid salaries to your employees in Apr, you must file the withholding tax return by May 10th

It's important to understand that the requirement to file a withholding tax return is not limited to salary payments. Any payment that requires taxes to be withheld must be reported on the withholding tax return.

*For instance, if you paid a loyalty payment to a foreign entity, you must also withhold taxes and report the payment on the withholding tax return.

*If you want to know about non-taxable items for your salary, Please refer below link.

4.Submission of 'monthly' payment statement for business incomer and temporay salary income (31st May)

The payment statement is a necessary document that outlines information about the individuals or entities who have received payments from you. This includes details about their income and any taxes that have been withheld.

*For instance, when you pay your employees, you are required to withhold taxes and pay them to the tax office. Additionally, you must submit a payment statement to the tax office to report the withheld taxes.

G-tax(Seoul, Korea) Tax firm specializing in foreign companies

If you are in search of a reliable English-speaking tax accountant, please don't hesitate to contact us! G-Tax Firm specializes in providing tax services exclusively for foreigners and foreign corporations in Korea. With extensive experience working with international companies, you can trust us for accurate and professional assistance

Thank you for read my article! I hope it helps.

If you want to see more information about Korea tax and accounting, please follow us.

And if you need help for your tax filing or accountung or looking for CPA in Korea, don't hesitate to contace us

G-tax / Certified Tax Accountant / Steven Yang

+82 10 9599 7152 / +82 2 467 2025

steven@g-tax.kr